How the RV Tax Credit Can Help You Save Thousands and Travel Freely

Thinking of upgrading your RV or investing in a solar-powered setup? You might be sitting on a golden opportunity to save big through federal tax credits and deductions. RV owners can qualify for several RV tax credits that not only help reduce your annual tax bill but also make your travels more sustainable and affordable.

Let’s dive into what makes you eligible and how you can claim these valuable benefits the right way.

What Is the RV Tax Credit?

The RV tax credit is part of the U.S. government’s initiative to encourage clean energy adoption and responsible travel. It includes federal clean energy credits, mortgage-related deductions, and even business-use benefits for owners who use their RVs as part of their livelihood.

In short: if your RV serves as your home, office, or solar-powered adventure base, there’s a good chance you qualify for financial rewards.

RVs Used as a Primary or Secondary Residence

If your RV includes a sleeping area, kitchen, and bathroom, the IRS may classify it as a home on wheels. This classification allows you to claim the same mortgage interest deduction that traditional homeowners enjoy — as long as your RV loan is secured by the vehicle itself.

Eligibility checklist:

✅ The RV serves as your primary or secondary residence

✅ The loan is secured by the RV

✅ You pay interest on that loan

Benefit: You can deduct the loan interest from your taxable income, effectively reducing your annual tax bill.

Pro tip: Thinking about transitioning to full-time RV living? Don’t miss our guide, From Hookups to Sun Power: Simple Guide to RV Solar Panels. “It’s packed with creative guides and practical advice to help you transition into RV living smoothly.

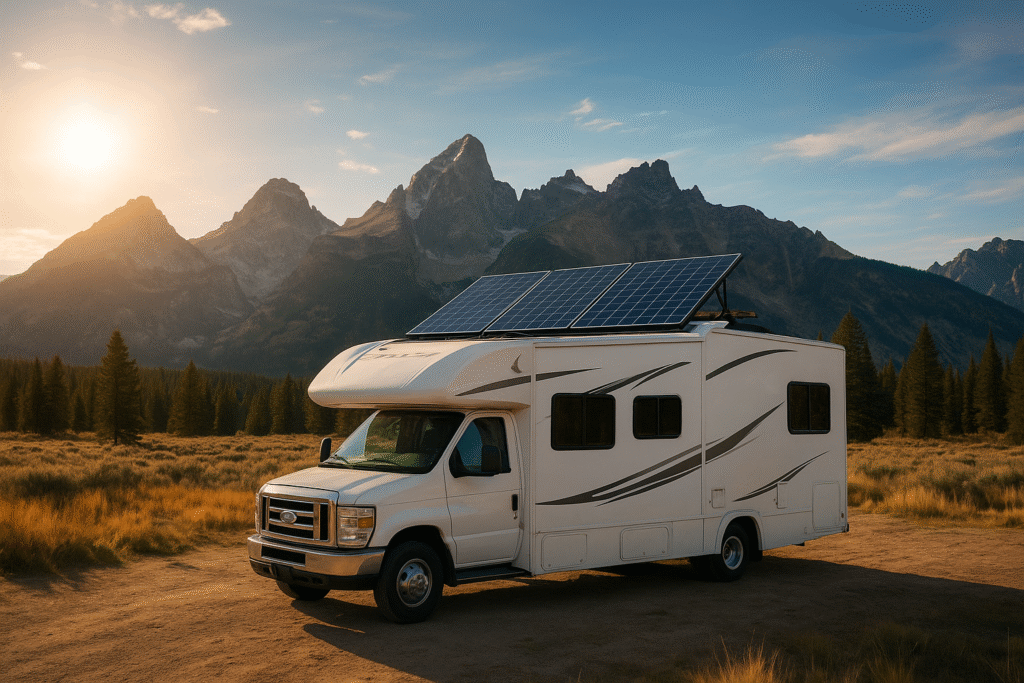

2. RVs With Solar Panels or Renewable Energy Systems

The biggest win for eco-conscious travelers comes from the Residential Clean Energy Credit (previously the Solar Investment Tax Credit).

If your RV has solar panels, you can claim 30% of the total installation cost including labor and equipment as a direct tax credit.

Example:

Spend $10,000 on a new RV solar setup → Get $3,000 back when you file your taxes.

Requirements:

- Solar panels must be newly installed

- The RV must qualify as a residence (primary or secondary)

This credit is valid through 2032, making 2025 a great year to start your energy-efficient RV transformation.

Ready to go solar? Find a certified solar installer near you and make sure your system qualifies for the federal tax credit.

3. RVs Used for Business Purposes

If you’re a freelancer, content creator, travel nurse, or small business owner using your RV for work congratulations, you may qualify for additional deductions.

You can write off:

- Depreciation on your RV

- Maintenance and insurance

- Fuel and travel costs

- Equipment used for business (Wi-Fi, computers, etc.)

Just remember: you can only deduct the business-use percentage. If you use your RV 60% for work and 40% for leisure, then only 60% of your eligible expenses can be claimed.

🧾 Tip: Keep a mileage log and expense records to strengthen your case during tax season.

Key Benefits of the RV Tax Credit

- Save Thousands on Clean Energy Upgrades – The 30% solar credit can drastically cut costs for eco-friendly RV improvements.

- Reduce Your Annual Tax Bill – Interest deductions lower your taxable income, which means paying less in federal taxes.

- Offset Business Expenses – Entrepreneurs who live or work on the road can maximize their deductions for better financial freedom.

- Promote Sustainability – Every solar-powered mile helps reduce your carbon footprint while making your RV adventures more self-sufficient.

“Before investing in your RV solar setup, make sure you understand how long your panels will last and what warranties actually cover.

🔗 Read our complete Solar Panel Warranties & Lifespan Guide to make a smarter, long-term decision

How to Claim Your RV Tax Credit

Claiming your RV tax credit is straightforward once you have your documentation ready. Here’s how to do it:

- Collect receipts for your solar installation, RV loan, or any qualified energy upgrade.

- Fill out IRS Form 5695 (for Clean Energy Credits).

- Include Schedule A (Form 1040) for mortgage interest deductions.

- Add Schedule C (if you use your RV for business purposes).

- Submit your claim with your annual tax return.

Pro tip: The IRS updates tax forms each year, so always download the latest version before filing.

Important Notes

- Leased RVs do not qualify for the Clean Energy Credit.

- Personal-use RVs without solar or home designation won’t qualify.

- State-specific rebates or solar incentives may also apply — check your state’s energy website for additional perks.

If you’ve been curious about powering your RV with solar but don’t know where to start, this guide covers the basics without getting too technical: solarinstallersnearme.org/rv-solar-panels-guide”

Why It Matters More Than Ever

With energy costs rising and sustainability becoming a priority for travelers, the RV tax credit isn’t just about saving money — it’s about building a lifestyle that’s financially smart and environmentally responsible.

By going solar or upgrading your RV for better efficiency, you’re not only reducing your carbon footprint but also increasing your RV’s resale value and independence on the road.

Ready to Take the Next Step?

If you’re planning to install solar panels or purchase a new RV this year, don’t leave free money on the table.

Consult a certified tax professional or RV solar installer to confirm your eligibility before the filing deadline.

Start your journey toward energy-efficient, tax-smart travel today — because freedom on the road feels even better when it saves you money.